Price is the perceived value that is exchanged for something else. Value in our society is most commonly expressed in dollars and cents. Thus, price is typically the amount of money exchanged for a product.

Perceived value refers to the perception of the product’s value at the time of the transaction. After a consumer has used a product, the consumer may decide that its actual value was more or less than its perceived value at the time it was purchased. The price paid for a product is based on the expected satisfaction that the customer will receive but not necessarily the actual satisfaction of the customer.

The reality of online retail pricing is that the lowest price doesn’t guarantee always get the sale. Getting your online store into a pricing battle could hurt you in the long term as well. When you consistently price too low, your customers will always expect the lower price. Even with plenty of customers, you still may not enjoy a profit. Over time you could lose even your most loyal customers.

Pricing Objectives

1. Profit-Related Objectives

This objective is aimed, simply, at making as much money as possible for your business.

Price has both a direct and indirect effect on your profits. The direct effect relates to whether the price actually covers the cost of goods sold. Price affects profit indirectly by influencing how many units sell.

√ Profit margin maximisation: Seeks to maximise the per-unit profit margin of a product.

√ Profit maximisation: Seeks to earn the greatest dollar amount in profits.

2. Sales-Related Objectives

Sales-oriented pricing objectives seek to boost sales volume or market share. A company's market share measures its sales against the sales of other companies in the industry.

The main sales-related pricing objectives include:

√ Sales Growth

It is assumed that sales growth has a direct positive impact on profits so pricing decisions are taken in way that sales volume can be raised. Setting a price, altering or modifying policies are targeted to improve sales.

√ Targeting Market Share

Pricing decisions are taken in such a way that enable your company to achieve targeted market share. Market share is a specific volume of sales determined in the light of total sales in an industry. For example, your company may try to achieve a 25% market share in the relevant industry.

√ Increase in Market Share

Price and pricing are taken as the tools to increase market share. When you realise that your market share is lower than expected it can be raised by appropriate pricing. Pricing is aimed at improving market share.

3. Competition-Related Objectives

Every company tries to react to their competitors with appropriate business strategies such as price adjustment.

√ To Face Up to the Competition

Today’s markets are characterised by intense competition and companies set and modify their pricing policies so as to respond to their competitors. Many companies use price as a powerful tool to react to the level and strength of competition.

√ To Deter Rivals

Prevent the entry of competitors can be one of the main pricing objectives. To achieve this objective, a company keeps its price as low as possible to minimise profit attractiveness of products. For instance, predatory pricing is used by monopolists to either deter new entrants from entering the market or to drive competitors out of the market, by offering low prices at which its (potential) competitors cannot be profitable.

√ Signal Quality

Buyers believe that a high price is related to high quality. In order to create a positive image in customers' minds that your product is superior to that offered by close competitors, you will design your prices accordingly.

Considerations for Pricing Strategies

1. Costs

Before you set your pricing, work out the costs involved with running your business. These include your fixed costs and variable costs.

2. Customers

Know what your customers want from your products and services. Are they driven by the cheapest price or by the value they receive? What part does price play in their purchase decision?

Also look at what you are selling, are your current customers buying high-end or low-end products and services? This information will help you determine if your price is right, what level of service or inclusions you should be offering and lastly if you are targeting the right market.

3. Positioning

Where do you want to be in the marketplace? Do you want to be the most expensive, luxurious, high-end brand in your industry or the cheapest? Once you have decided, you will start to get an idea of your ideal pricing.

4. Competitors

Competition can impact your price and its sensitivity. Generally, the less competition you have, the higher demand there is for your product. Changes in your competition may also impact your price, such as a new competitor entering the market could affect the level of demand for your products or services.

Your competitors' activities can also have an impact on your pricing decisions, whether they have a new feature, an advertising campaign running or a price reduction.

If you are a new player in the market, it is often suggested to look at what others in the market are doing. One does not simply imitate the pricing strategy but takes inspiration from other businesses. If it worked for them, you could always learn from it.

5. Unique Selling Point (USP)

What makes you different? Every company has to tackle this question to determine their value point and target market. For online retailers, a unique factor could be excellent customer service, free and speedy delivery, or a unique product you can't find elsewhere.

6. Price Sensitivity in the Market

Price sensitivity refers to the changes in customer demand as a result of price changes. For example, commodity goods such as petrol have high price sensitivity. The difference of a few cents in price can impact a customer's behaviour.

Some markets are more sensitive to price increases than others. Price sensitivity can change over time based on a number of factors including changes in the economic environment, competition or demand. Factors other than price, such as quality, service, and uniqueness, can also influence price sensitivity.

7. Level of Demand

Demand for your products or services will have a great influence on price. Generally, the higher demand for your product, the higher you can price your product and services. Demand can also be influenced by price. For example, lowering the price of a product can increase demand temporarily.

The demand for your products or services may be elastic or inelastic:

√ If the demand is elastic, a change in pricing has a significant effect on the demand (i.e. after a price rise customers may choose not to buy the product).

√ If the demand is inelastic, a price change has little effect on demand (i.e. customers will still buy the item, regardless of the price).

Elasticity is dependent on a number of factors, including:

√ Is the product a necessity or a luxury? (medications vs. fine dining)

√ Are there any substitutes available? (for example, if rice is not available, customers could buy potatoes instead)

√ Are there any complementary products? (when the price of one product goes down, demand for another product goes up, i.e. razors and shaving cream)

8. Government Regulations

Depending on your industry or how global your market is, local and international regulations can sometimes influence your pricing decisions.

1. Cost-Plus Pricing

Cost-plus pricing is is simple and fast, allowing you to add a profit margin to any product you are selling. All you have to do is calculate your total cost per product and then add a percentage of markup as the final price.

It can save a lot of time when you have hundreds of different products on sale. It is best used in businesses that have a diverse range of products that have competitive pricing such as supermarkets.

2. Keystone Pricing

This strategy entails the retailer placing a mark-up on top of the wholesale cost of the product that they paid for. It is a pricing method whereby merchandise is priced for resale at an amount that is double the wholesale price or cost of the product.

Keystone Pricing: Cost x 2 = Selling Price

It is generally not advised to use keystone pricing for all products in your company, as that would make everything too expensive. For example, a retailer might say, "The only department in our retail store that allows keystone pricing is our gift department. Because we face a lot of competition with our other product categories, the remainder of our merchandise is priced using a 40 percent markup."

Furthermore, keystone is also discouraged if your company sells merchandises that have high price sensitivity or high product cost. For example, computers are notorious for their low profit margins and competitive prices.

3. Value-Based Pricing

Don’t just consider pricing your product based on cost.

“How much the customer is willing to pay for the product has very little to do with cost and has very much to do with how much they value the product or service they’re buying,” says Eric Dolansky, Associate Professor of Marketing at Brock University.

Value-based pricing setting a price based on how much the customer believes what you’re selling is worth. For example, a customer may value a product or service much more if it saves them a lot of time. The price can then be set to reflect this saving.

This final price is termed True Economic Value (TEV). How much a customer will pay for a product/service that can deliver more value than its closest competitor. For instance, the television you are selling is identical to your closest competitor, except your screen is 10 inches wider. How much would your customer be willing to pay for that extra 10 inches? That would be the value of performance differential.

Dolansky provides the following advice for entrepreneurs who want to determine a value-based price:

★ Pick a product that is comparable to yours and find out what the customer pays for it.

★ Find all of the ways that your product is different from the comparable product.

★ Place a financial value on all of these differences, add everything that is positive about your product and subtract any negatives to come up with a potential price.

★ Make sure the value to the customer is higher than your costs.

★ Demonstrate to customers why the price will be acceptable, which includes talking to them.

★ If there is an established market, the current price range will help educate you about the customers’ price expectations.

This pricing strategy is the practice of using competitor pricing data as a benchmark and consciously pricing products below them to lure consumers onto your website.

This strategy can be a winner if you manage to negotiate a lower cost per unit with your suppliers, while at the same time focusing on cutting costs elsewhere and actively promoting your special pricing.

When the seller starts pricing, they cannot blindly set a price according to their own subjective wishes, they must first look at the other sellers' pricing, compared to it and then set a reasonable range.

Out-pricing your competitors can influence price-conscious customers to purchase your products over similar ones. It results in a narrow gap between cost and profit.

When a good or service is offered by many vendors at a relatively similar price, you can charge competitively. For instance, a computer retailer can decide to sell hardware at a loss if they can sell their software or services for a higher margin order to capture the sale and result in a projected positive lifetime customer value.

This strategy can be difficult to sustain when you’re a smaller retailer. Lower prices mean lower profit margins and thus, you’ll have to sell higher volume than competitors.

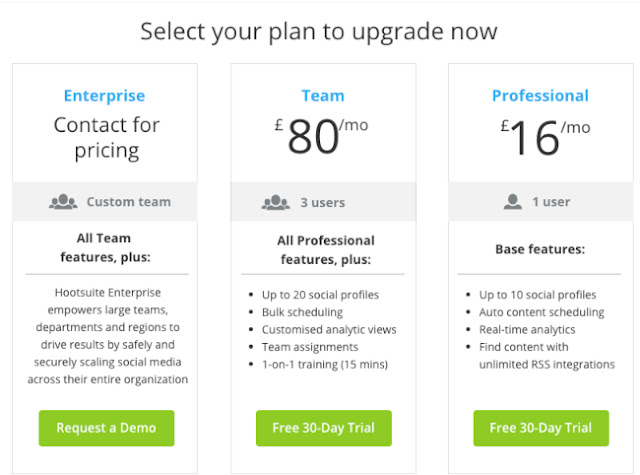

5. Lead Generation Model

This strategy is the practice of engaging users to actively request additional information online. As pricing is contingent upon terms and conditions stipulated in pre-determined contracts, this strategy ensures that the visitor does take action and click to request information expecting to hear back from a sales representative in regards to product details and pricing terms. Users can adopt this strategy online if they require a portal login for their customized pricing needs.

6. Manufacturer Suggested Retail Price (MSRP)

This is the price the manufacturer recommends an online retailer uses to sell their products. The reason manufacturers doing this was to help standardise prices of products across multiple locations and retailers.

The downside of using MSRP as your pricing strategy is that you’ll have the same prices as your competitors. So, online sellers have to differentiate your store in other ways such as free shipping.

7. Bundle Pricing

Bundle pricing is a type of promotional pricing tactic that combines multiple products into a bundle that sells at a lower price than if they were sold individually. The bundle package price will also give your customers the perception that they are getting a good deal.

A study looking at the effect of bundling products in the early days of Nintendo's Game Boy hand-held console found that the most products were sold when the devices were "bundled" with a game.

Traditionally, online retailers use this strategy to create a higher perceived value for a lower cost which can ultimately lead to driving larger sales volume however when you bundle products up for a low-cost, you'll have trouble trying to sell them individually at a future higher cost.

8. Discount Pricing / Promotional Sale Pricing

Consumers love sales, coupons, rebates, seasonal pricing and other promotion-related markdowns, i.e. grabbing a bargain.

Discounts are great for attracting a larger amount of traffic to your online store and getting rid of out-of-season or old stock, whilst attracting a more price-conscious group of customers. However, if utilised too often, you might gain a reputation as a bargain retailer, which could deter consumers from purchasing your products for the usual price.

Once you know your margins and have priced accordingly, then you can offer incentives to motivate your customers. Even if you can’t sustain an ultra-low price in the long term, you can always offer limited time pricing to reach these customers, e.g. “purchase today and receive 20% off!”. This also gives a sense of urgency to the purchase, i.e. tomorrow will be too late.

If you have surplus products, you can affordably offer 2 for 1. Additionally, buy one product, get 50% off the second. In reality, the customer is only getting a 25% discount.

Furthermore, it can make sense to offer customers a discount for buying in bulk because it helps you secure customers in a competitive market. It also encourages customers to make larger orders, which tend to be more profitable than a series of small orders.

Year-end sales such as Black Friday and Chinese 11.11 Single’s Day are a great time for brands to use promotional sale pricing.

Even though products sold during mega sale events are usually on massive discounts, the sheer volume of products sold would still yield a profit. In a way, brands are also forced to go on sale for the fear of losing out to their competitors who are using the strategy.

Read more: Shopee Malaysia - Online Shopping Platform With Great Deals

9. Loss Leader Pricing

Loss leader pricing is defined as “a pricing strategy where a store sells selected goods below cost to attract customers who will make up for the losses with additional purchases of profitable goods.” Simply put, loss leader pricing brings customers into a store using aggressive discounts on selective items (the loss leaders) in hopes that once customers are in the store, their other purchases make up for the profit hit taken on the loss leader.

This strategy assumes that an item sold below market value will encourage customers to buy more overall. Using this strategy, online retailers have the opportunity to upsell, cross-sell and increase the total shopping basket value. Even if the profit is not impressive, this strategy stimulates customers' interest, opening the door for further transactions.

The end goal is to sacrifice losing money on one item in order to make a profit on the rest of the products sold. This tactic can work wonders, especially, when you consider any complementary or additional purchases a consumer might make, resulting in a boost in overall sales.

To execute a loss leadership strategy successfully, you need to sell an additional product that complements the loss leader or makes it fully functional. For example, HP discounts printer prices so it can make profits on the sale of cartridges. Amazon sells Kindles for a discounted price because it makes back the profit on the eBooks that customers purchase.

10. Psychological Pricing / 9-Dollar Pricing

By using psychological pricing, you tap into the irrational part of a consumer’s brain and trigger impulse purchasing through the perception of a bargain deal. However, it doesn't work when you are selling prestigious goods. Lowering your price from a whole number like $1,000 to $999.99 will actually hurt the luxury brand perception of what you're selling.

Along with the power of 9 in the prices, a tiny monetary sign $ or £ sign helps take away the sting of the price. Amazon creates a sense of urgency to encourage sales with the following - "only 2 left in stock - order soon", which is a psychological tactic.

Usually in the supermarket or shopping malls, the price of many products ends up with 9, such as 19 dollars or 199.99 dollars. Although 20 dollars and 19 dollars have only one dollar difference, the consumers subconsciously will feel a lot cheaper.

Because we read from left to right, we see the first digit first, and that forms an anchor in our head. Anchoring is a type of heuristic that allows us to make a subsequent evaluation based on the first piece of information we see.

Traditionally, merchants do this with ending the price with an odd number like 5, 7, or 9. An example would be using $8.99 instead of $9.00 as your purchase price. When it comes to deciding which odd number to go to, the number 9 reigns supreme.

Researchers at MIT and the University of Chicago ran an experiment on a standard women's clothing item with the following prices $34, $39, and $44. The result was that the item at $39 outsold its cheaper counterpart price of $34.

11. Segmented Pricing

This is when an online retailer fixes or sets more than one price for a product, irrespective of its production and distribution costs being the same. For instance, geographical locations, in areas or regions where the customers are less price sensitive, the prices of products are higher and vice versa.

Here are some of the popular ways to use segmentation as a pricing strategy:

⮞ Seasonal Pricing/Time of Purchase: Hotel rooms cost more during peak seasons and holidays than the normal days. In the fashion industry, fashionistas will pay a premium to wear the latest styles while those on a budget will wait for the end of season clearances.

⮞ Geographical Locations: In areas or regions where the customers are less price sensitive, the prices of products are higher and vice versa.

⮞ Based on perceived value and customer segments.

⮞ Volume: Discounts are given for large/bulk orders, the larger the volume you order, the lower the price per unit. Also offering a product package or a bundle could reduce the cost. For example, a standardised Chinese meal combo could have a soup, starter, rice and noodles. However, individual items on the menu, on ala carte could be priced differently.

⮞ Channel Purchase: For example, online vs. in-store purchase. Customers who purchase online can be offered a lower price because the cost to serve this purchase is lower.

⮞ Time Used: Many resorts charge more for their vacation packages depending on the time of year. Frugal travelers will travel to sunny destinations in late March for better deals while other travelers will pay more to get away from the January deep freeze.

⮞ Location: Theaters and concert venues charge based on how close you are to the stage.

12. Anchor Pricing

This is another psychological tactic where you list both a sale price and the original price to establish the amount of savings a consumer perceives to be gaining from making the purchase.

The original price establishes itself as a reference point in the minds of consumers which they then anchor onto to form a favourable opinion of the marked down price.

Another way you can take advantage of this principle is to intentionally place a higher priced item next to a cheaper one on your web store to draw the customer's attention to it.

Anchor pricing will automatically trigger a response in the consumer of having found a good deal, pushing them to act on their impulsive buying habits.

13. Dynamic Pricing

Dynamic pricing means to set a flexible price in response to market change and competition status. In other words, you are able to set at an optimal price by constantly monitoring the market demands and customers' willingness to pay.

Here’s a few examples of dynamic pricing:

⮞ The concept of “Happy hours” in a bar worked in attracting customers. Although the prices on drinks were slashed, but this attracted a lot of customers, which increased the amount of business did during that time. This increased their profits for that time. It proved to be so effective that most bars and pubs adopted it as well.

⮞ Take airline ticket prices as example, during the weekends and Fridays, you’ll see that prices are higher than on regular weekdays, since airlines know that more people are inclined to travel during those times.

14. Product Line Pricing

Product line pricing is a process in which products and services in a specific category are given different price points. The price difference is usually to differentiate products according to differentiating features. This provides more options for the consumers and thus more opportunities for sales.

Starbucks uses product line pricing for their drink sizes to cater to different needs. Their cheapest tall size serves as the anchor, so convincing customers to upgrade is easy as the price increase is fairly small.

This is an extremely popular pricing strategy and can be applied to virtually any business which has products at different price points.

15. Penetration Pricing

Penetration pricing is one of the pricing strategies used when introducing a new product into the market. The introductory price used in this strategy is always significantly lower than its usual price or that of the competition. This discourages competitors because of the low profit margin.

It is most commonly associated with a marketing objective of increasing market share or sales volume, rather than to make profit in the short term. It is effective in attracting customers to try it, with hopes that customers will like it enough to purchase it at full price eventually.

In August 2003, Frito-Lay launched their Stax potato chips to compete with Pingles, which was popular at the time. Stax was identical to Pringles chips in many ways, from the shape of the chips to even the design of their containers. They were given an initial price tag of $0.69 for its first few months.

After their product had obtained a decent amount of market share, Frito-Lay eventually adjusted the price to over $1, similar to market price.

Penetration pricing is also a great way to measure public reception to the new product. You can follow up purchases with questionnaires for customers to give feedback on the product.

16. Price Skimming

The price skimming strategy is another way to introduce a new product, but it is the opposite of the penetration pricing strategy. In price skimming, the initial price of the new product is higher during the introductory period. As the product moves through its life cycle, this elevated price tag will generally lower to normal market pricing when other competitors enter the market. As the price falls, more and more consumers afford to buy the product.

With this strategy, you’re targeting two different audience segments: early-adopters and status-conscious consumers are more likely to pay full price for the latest gadget or trend, and the price-sensitive consumer is more likely to purchase once the item is marked down.

Price skimming has four important advantages. First, a high initial price can be a way to find out what buyers are willing to pay. Second, if consumers find the introductory price is too high, it can be lowered. Third, a high introductory price can create an image of quality and prestige. Fourth, when the price is lowered later, consumers may think they are getting a bargain.

A brand that uses price skimming needs to be well-established enough in an industry which has stiff competition, like consumer electronics. For instance, when Samsung launched their Galaxy Note 9 in August 2018, it was available for pre-order at $999. It features top-end features and the Note lineup has always been a crowd favorite. In December 2018, it was available in selected places at $699.

Consumer electronics is a red sea of competition, with brands constantly jostling for market share with the latest technology and innovative designs. This strategy is often used to target “early adopters” of a product or service. Early adopters of smartphones will gladly pay the premium price to be the first to own the newest devices.

By the time competitors enter the market with new products, Samsung would have earned a significant amount of sales from early adopters, and can now reduce their prices to cater to the more price-sensitive customers.

Pulling off price skimming will require products that consumers will want to own for bragging rights and to be perceived as trendy or luxurious.

17. Everyday Low Pricing

Everyday low price (EDLP) is a pricing strategy offering consumers a low price without having to wait for sale price events or comparison shopping.

EDLP saves online stores the effort and expense needed to mark down prices in the store during sale events. EDLP is believed to generate shopper loyalty.

An example of a successful brand that uses the EDLP strategy is Trader Joe’s. Trader Joe’s is a private-brand label that conducts a niche marketing strategy describing itself as the “neighborhood store”. The firm has been growing at a steady pace, offering a wide variety of organic and natural food items that are hard to find, enabling the business to enjoy a distinctive competitive advantage.

At Trader Joe’s, its everyday low prices are available to everyone. It doesn’t require membership for its customers to enjoy its low prices. The firm states that “every penny we save is every penny our customer saves”

18. High/Low Pricing

High-low pricing is a method of pricing where the goods or services offered by the organization are regularly priced higher than competitors. However, through promotions, advertisements, or coupons, lower prices are offered on other key items consumers would want to purchase. The lower promotional prices are designed to bring customers to the organization where the customer is offered the promotional product as well as the regular higher priced products.

Customers for firms adopting this type of strategy also have strong preference in purchasing the products sold in this type or by this certain firm. They are loyal to a specific brand.

Many brands are using high-low pricing strategies, especially in the shoe industry such as Reebok, Nike, and Adidas. Also high-low pricing is extensively used in the fashion industry by companies including Macy’s and Nordstrom.

This is where you benchmark your competition but consciously price your products above theirs and brand yourself as being more luxurious, prestigious, or exclusive. This pricing strategy can work a magic effect on your business and products by giving consumers the perception that your products are of better quality and more exclusive due to the higher amount they’ll be paying for them.

For a brand to utilize the premium pricing strategy effectively, it must first work hard to establish a value perception. Every part of the consumer journey and marketing messaging has to reinforce that perception of high quality and luxury. If everything about your brand conveys the message of quality and luxury, then customers will deem it worthwhile to spend their money on you.

A study from economist Richard Thaler looked at people hanging out on a beach wishing for a cold beer to drink. They’re offered two options in this scenario: purchasing a beer at either at a run-down grocery store or a nearby resort hotel. The results found that people were far more willing to pay higher prices at the hotel for the same beer. Well, that's the power of context and marketing your brand as high-end.

Some businesses brand themselves as more luxurious, prestigious, or exclusive. For example, a premium price works in Starbucks' favor when people pick them over a lower-priced competitor like Dunkin' Donuts. Another instance is iPhone which adopting premium pricing strategy, and always be viewed as a luxury good and more expensive than competitors.

Starbucks is a master of employing value based pricing to maximize profits, and they use research and customer analysis to formulate targeted price increases that capture the greatest amount consumers are willing to pay without driving them off.

Rather than trying to compete with cheaper chains like Dunkin, Starbucks uses price hikes to separate itself from the pack and reinforce the premium image of their brand and products. Since the majority of their customer base is fairly insensitive to price, Starbucks coffee maintains a fairly inelastic demand curve, and a small price increase can have a huge positive impact on their margins without decreasing demand for beverages.

Bottom Line

Do your research on your target markets, customers and costs to decide an optimal pricing strategy for your business. Also, you can use multiple pricing strategies for various products and services within your business.

Each product has its place and purpose, and a specific pricing tactic that suits its positioning will optimize your sales and boost customer loyalty!

For each kind of product, once the price is determined, one should try to avoid frequent changes in prices, this will usually lead to negative impact on the sales.

Lastly, all pricing strategies are double-edged swords. What attracts some customers will turn off others.

Edited by: 浪子

Bibliography

Shari Waters. (2019). Keystone Pricing in Retail. Retrieved from https://www.thebalancesmb.com/keystone-pricing-in-retail-2890192

Shreyans Parekh. (n.d.). 5 Effective Online Pricing Strategies for Your E-Commerce Site. Retrieved from https://apttus.com/blog/5-effective-online-pricing-strategies-for-your-e-commerce-site/

Moira McCormick. (2017). Best Pricing Strategies for Online Retail. Retrieved from https://blog.blackcurve.com/best-pricing-strategies-for-online-retail

Amanda Jesnoewski. (2018). Five Factors to Consider When Pricing Products or Services. Retrieved from https://www.smartcompany.com.au/business-advice/five-factors-to-consider-when-pricing-products-or-services/

Mengwei Zhang. (2017). Pricing Strategy of Taobao, the Largest Online Shopping Platform in China. Retrieved from https://medium.com/@ucabmwz/pricing-strategy-of-taobao-the-largest-online-shopping-platform-in-china-16c2433e520a

Moira McCormick. (2016). Why is a Pricing Strategy the Key to Selling Success in Online Retail. Retrieved from https://blog.blackcurve.com/why-is-a-pricing-strategy-the-key-to-selling-success-in-online-retail

Lindsey Peacock. (2019). Pricing Strategy: 10 Ways to Find the Perfect Price for Your Products. Retrieved from https://www.shopify.com/blog/pricing-strategies

BDC. (n.d.). How to Price Your Product: 5 Common Strategies. Retrieved from https://www.bdc.ca/en/articles-tools/marketing-sales-export/marketing/pages/pricing-5-common-strategies.aspx

Samuel Hum. (2019). How to Boost Loyalty With Online Pricing Tactics. Retrieved from https://www.referralcandy.com/blog/pricing-tactics/

Liz Downs. (2019). Ecommerce Insights: 4 Tips to Price Your Products to Compete Online. Retrieved from https://www.volusion.com/blog/how-to-price-ecommerce-products-to-compete-online/

Department of Industry, Innovation and Science (Australia). (2018). Select Pricing Strategies. Retrieved from https://www.business.gov.au/products-and-services/pricing/select-pricing-strategy

Department of Industry, Innovation and Science (Australia). (2018). Analyse Pricing Influences. Retrieved from https://www.business.gov.au/products-and-services/pricing/analyse-pricing-influences

Nelson Pinto. (n.d.). Boost Your Marketplace With the Right Pricing Strategy. Retrieved from https://jungleworks.com/pricing-strategy-for-online-marketplaces/

Pricing Strategies and Future Trends. (n.d.). Retrieved from https://opentextbc.ca/businessopenstax/chapter/pricing-strategies-and-future-trends/

Business Queensland. (2017). Pricing Strategies. Retrieved from https://www.business.qld.gov.au/running-business/marketing-sales/marketing-promotion/pricing/strategies

Patricia Poladian. (n.d.). Different Pricing Strategies in Business Marketing You Need to Know. Retrieved from https://www.moneycrashers.com/different-pricing-strategies-business-marketing/

Anthony Capetola. (2017). Pricing Strategies to Help Your E-commerce Business Sell More Online. Retrieved from https://blog.salesandorders.com/pricing-strategies-to-help-your-ecommerce-business-sell-more-online

Moira McCormick. (2017). Why Pricing Objectives Are Fundamental to Business Success. Retrieved from https://blog.blackcurve.com/why-pricing-objectives-are-fundamental

Mark Reijman. (2017). Eight Pricing Strategies That Drain Your Wallet. Retrieved from https://www.thestar.com.my/business/business-news/2017/03/26/eight-pricing-strategies-that-drain-your-wallet/

Ashley Han. (2019). Smart E-commerce Pricing Strategy Using Web Scraping. Retrieved from https://www.datadriveninvestor.com/2019/05/09/smart-e-commerce-pricing-strategy-using-web-scraping/#

Demi Oba. (2017). The Pros and Cons of Loss Leader Pricing for Online Retailers. Retrieved from https://blog.smile.io/pros-cons-of-loss-leader-pricing-for-online-retailers

MBASkool. (n.d.). Segmented Pricing. Retrieved from https://www.mbaskool.com/business-concepts/marketing-and-strategy-terms/2744-segmented-pricing.html

Fusebill Inc. (n.d.). Improve Your Pricing Strategy with Price Segmentation. Retrieved from https://blog.fusebill.com/pricing-strategy-segmentation

Krista Fabregas. (2017). How to Price a Product – The Ultimate Product Pricing Strategy Guide for Small Businesses. Retrieved from https://fitsmallbusiness.com/product-pricing/

How Dynamic Pricing is Disrupting Online Retail in 2019. (2018). Retrieved from https://www.intelligencenode.com/blog/dynamic-pricing-disrupting-online-retail-2017/

Lumen. (n.d.). Specific Pricing Strategies. Retrieved from https://courses.lumenlearning.com/boundless-marketing/chapter/specific-pricing-strategies/

Tucker Dawson. (2019). How Starbucks Uses Pricing Strategy for Profit Maximization. Retrieved from https://www.priceintelligently.com/blog/bid/184451/how-starbucks-uses-pricing-strategy-for-profit-maximization

The Strategist - Online Pricing Strategies for eCommerce

Reviewed by 浪子

on

August 12, 2019

Rating:

Reviewed by 浪子

on

August 12, 2019

Rating:

Reviewed by 浪子

on

August 12, 2019

Rating:

Reviewed by 浪子

on

August 12, 2019

Rating: