“Entertainment” includes:

(i) the provision of food, drink, recreation or hospitality of any kind; or

(ii) the provision of accommodation or travel in connection with or for the purpose of facilitating entertainment of the kind mentioned in paragraph (i) above,

by a person or an employee of his in connection with a trade or business carried on by that person.

“Entertainment related wholly to sales” means the entertainment which is directly related to sales provided to customers, dealers and distributors excluding suppliers.

“Recreation and hospitality” would include:

(i) a trip to a theme park or a recreation centre;

(ii) a stay at a holiday resort;

(iii) tickets to a show or theatre; and

(iv) gifts and give-aways.

General Provision for Deductibility

Generally, an expense that is wholly and exclusively incurred in the production of income is allowable as a deduction against gross income under subsection 33(1) of the Act. Expenses that are included in subsection 39(1) of the Act are disallowed as a deduction against gross income.

Proviso to Paragraph 39(1)(l) of the Act

The following categories of entertainment expenses included in proviso (i) to (vii) of paragraph 39(1)(l) of the Act would be wholly allowable. The categories of entertainment expenses with examples are as follows:

1. The provision of entertainment to employees

Expenditure on food, drink and recreation provided to employees except where such expenditure is incidental to the provision of entertainment for others. Examples of such entertainment expenses are expenses on free meals and refreshment, annual dinners, outings, family day or club membership for employees.

Where the cost of outings, family day trips includes cost of travel, food and accommodation, only the amount relating to food and accommodation is deductible. The cost of travel is not a deductible expense as it is specifically disallowed under paragraph 39(1)(m) of the Act.

Example 1

Active Sdn Bhd entertains its suppliers on 15 December 2004 and the cost is RM 3,000. Some employees of Active Sdn Bhd are also present.

As the entertainment is principally for the suppliers of Active Sdn Bhd, an amount of fifty per cent (50%) is disallowed and the balance is allowable.

Example 2

Mestijaya Sdn Bhd entertains its employees at an annual dinner on 10 December 2004. Some suppliers are also invited to the dinner. The cost of the dinner is RM 10,000.

As the entertainment to the suppliers of Mestijaya Sdn Bhd is only incidental to the provision of entertainment to employees, the full amount incurred RM 10,000 is allowable.

Example 3

To foster family values among its employees, Warna Sdn Bhd provided a family day trip for its employees to Langkawi. The total cost incurred amounted to RM 70,000 comprising cost of travel totalling RM40,000 and cost of food, drinks and accommodation which amounted to RM 30,000.

Warna Sdn Bhd is allowed a deduction for the cost of food, drinks and accommodation spent on its employees amounting to RM 30,000. Warna Sdn Bhd is not allowed any deduction for the cost of travel of RM 40,000.

2. The provision of entertainment for payment in the ordinary course of business

Expenditure on entertainment provided by a person to clients or customers for payment in the normal course of the business and where the nature of the business is to provide such entertainment for payment.

Examples of such entertainment are:

(i) Provision of cultural shows by restaurants or hotels at their premises to entertain their customers.

(ii) Meals provided by airlines or other transportation business to its passengers.

Expenses on entertainment provided by a person free of charge to clients or customers of the business which are not in the ordinary course of carrying on the person’s business would not be deductible.

Example 4

Syarikat Top Auto Service carrying on a car servicing business provides light refreshments such as tea, coffee, sandwiches to its customers while waiting for their cars to be serviced. The customers are not charged for the light refreshments provided.

The entertainment expenses incurred on the light refreshments by Syarikat Top Auto Service would not be deductible as it is not in the ordinary course of the car servicing business to provide such entertainment.

However this expenditure would qualify for deduction under proviso (vii) of paragraph 39(1)(l) of the Act.

3. The provision of promotional gifts at trade fairs or trade or industrial exhibitions outside Malaysia

Expenditure incurred on promotional gifts at trade fairs or trade exhibitions or industrial exhibitions held outside Malaysia for the purpose of promoting exports from Malaysia. Examples of such entertainment expenses are expenditure incurred on samples of products of the business, small souvenirs, bags and travel tickets provided as gifts to customers or visitors at a trade fair or trade or industrial exhibitions held outside Malaysia.

4. The provision of promotional samples of products of the business

Expenditure incurred on promotional samples of products of the business for the purposes of advertising that product for example:

(i) A complimentary drink or meal provided by a restaurant.

(ii) Free samples of drinks manufactured by the business given to schools or for functions.

(iii) Free samples of products manufactured/distributed by the business or free samples of new products.

5. The provision of entertainment for cultural or sporting events open to members of the public wholly to promote the business

Expenditure incurred on providing entertainment for cultural or sporting events which are open to members of the public for the purpose of promoting the business.

Examples of such entertainment are:

(i) Cultural events which relate to the promotion of the arts such as painting, sculpture, music, drama and dance. (National Day Parade is not considered a cultural event).

(ii) Sporting events, for example, badminton tournaments, golf tournaments, motor racing or swimming events.

In the provision of cultural or sporting events, the organiser may pay fees to the artistes or sportsmen, pay cost of passage, accommodation, food or recreation or t-shirt for artistes or sportsmen.

This proviso includes sponsorship of a cultural or sporting event. These events should be open to members of the public. If the event is open to members only, it cannot be considered as being open to the public.

6. The provision of promotional gifts within Malaysia of articles incorporating the logo of the business

Expenditure on promotional gifts within Malaysia consisting of articles incorporating a conspicuous advertisement or logo of the business. The deduction allowed in respect of promotional gifts is to be restricted to articles which are not products of the business on condition that the articles incorporate a conspicuous advertisement or logo of the business. The logo could either be affixed or embossed on the promotional products.

So long as the promotional gifts provided are made available on a nondiscriminatory basis to the public at large, they will qualify for deductions (as opposed to expensive gifts given to selected persons or when there is an absence of any business relationship the transaction done between the giver and recipient may not justify the gift and is not available to other members of the public).

7. The provision of entertainment related wholly to sales arising from the business

Expenditure on provision of entertainment which is related wholly to sales arising from the business.

The following are examples of such expenditure:

(i) Food and drinks for the launching of a new product.

(ii) Redemption vouchers given for purchases made.

(iii) Discount vouchers, shopping vouchers, concert or movie tickets, meal or gift vouchers and cash vouchers.

(iv) Free gifts for purchases exceeding a certain amount.

(v) Redemption of gifts based on a scheme of accumulated points.

(vi) “Free” maintenance/service charges or contribution to sinking fund by property developers.

(vii) Lucky draw prizes to customers.

(viii) Expenditure on trips given as an incentive to dealers for achieving the sales target.

(ix) Expenditure of the type shown in Example 4 (The entertainment expenses incurred on the light refreshments by Syarikat Top Auto Service would not be deductible as it is not in the ordinary course of the car servicing business to provide such entertainment. However this expenditure would qualify for deduction under proviso (vii) of paragraph 39(1)(l) of the Act.)

Expenses Disallowed under Paragraph 39(1)(l) of the Act

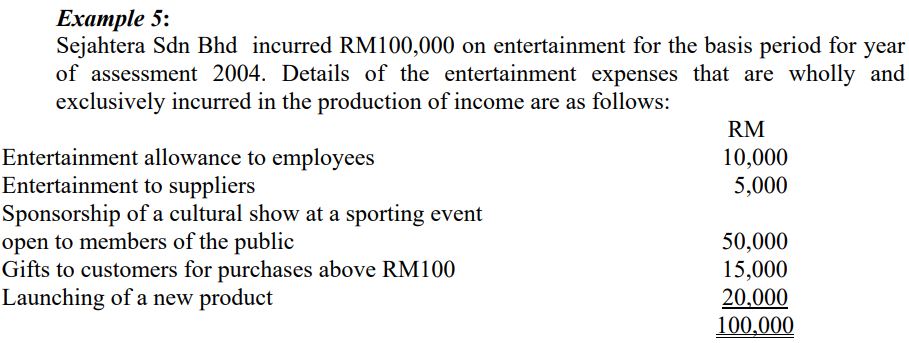

Entertainment expenses which are wholly and exclusively incurred in the production of income under subsection 33(1) of the Act and which do not fall into any of the categories of expenses enumerated in the proviso to paragraph 39(1)(l) of the Act would only qualify for fifty per cent (50%) deduction.

Such expenses would include the following:

(i) the expenses incurred in connection with specific business transactions;

(ii) existing clients or suppliers are entertained; and

(iii) allowances paid to employees for the purpose of defraying expenses incurred by the employees in the provision of entertainment.

The following example illustrates the treatment of entertainment expense:

Read: AirAsia BigPay (E-Wallet) - Sign Up Today To Get RM 10 Free Credit !

Edited by: ;浪子

Source: http://lampiran1.hasil.gov.my/pdf/pdfam/PR3_2004.pdf

Public Ruling No. 3/2004 - Entertainment Expense

Reviewed by 浪子

on

August 19, 2018

Rating:

Reviewed by 浪子

on

August 19, 2018

Rating:

Reviewed by 浪子

on

August 19, 2018

Rating:

Reviewed by 浪子

on

August 19, 2018

Rating: