A new SME definition was endorsed at the 14th NSDC Meeting in July 2013. The definition was simplified as follows:

a) Manufacturing: Sales turnover not exceeding RM 50 million OR full-time employees not exceeding 200 workers.

b) Services and other sectors: Sales turnover not exceeding RM 20 million OR full-time employees not exceeding 75 workers.

A business can qualify as an SME if it meets either one of the two specified criteria, namely sales turnover or full-time employees, whichever is lower.

Definition by Size of Operation

Microenterprises across all sectors: Sales turnover of less than RM 300,000 OR less than 5 full-time employees.

If a business fulfills either one criteria across the different sizes of operation, then the smaller size will be applicable. For example if a firm’s sales turnover falls under microenterprise but employment falls under small, the business will be deemed as a microenterprise.

Classification of Sectors

‘Manufacturing’ refers to physical or chemical transformation of materials or components into new products.

‘Services’ refer to all services including distributive trade; hotels and restaurants; business, professional and ICT services; private education and health; entertainment; financial intermediation; and manufacturing related services such as research and development (R&D), logistics, warehouse, engineering etc.

‘Others’ refer to the remaining 3 key economic activities, namely:

(i) Primary Agriculture

– Perennial crops (e.g. rubber, oil palm, cocoa, pepper etc.) and cash crops (e.g. vegetables, fruits etc.)

– Livestock

– Forestry & logging

– Marine fishing

– Aquaculture

(ii) Construction – Infrastructure – Residential & non-residential – Special trade

(iii) Mining & quarrying

Classification of economic activities for the purposes of definition will be based on the Malaysian Standard Industrial Classification (MSIC) 2008 codes.

Details of Qualifying Criteria

Sales turnover refers to total revenue including other incomes.

Full-time employees include all paid workers working for at least 6 hours a day and 20 days a month; or at least 120 hours a month. Full-time workers also include foreign and contract workers. However, the definition excludes working proprietors, active business partners and unpaid family members or friends who are working in the business and do not receive regular wages.

‘OR’ basis means that a business will need to satisfy either one of the two criteria used in the definition (whichever is lower).

If a business exceeds the threshold set under both criteria for 2 consecutive years (based on its financial year/ accounting period) then it can no longer be deemed as SMEs. Similarly, a business that is previously large can regress to an SME if it fulfills the qualifying criteria of SMEs for 2 consecutive years.

Scope of SMEs

In addition to the qualifying criteria i.e. sales turnover and full-time employees, there are additional conditions that must be fulfilled to be classified as SMEs:

1. Types of Establishment

SMEs refer to only pure business entities registered with the following bodies:

(i) Companies Commission of Malaysia (SSM) either under the Registration of Business Act (1956) or Registration of Company Act (2016) or Limited Liability Partnerships (LLP) Act 2012; or

(ii) Respective authorities or district offices in Sabah and Sarawak; or

(iii) Respective statutory bodies for professional service providers

2. Shareholding Structure

(i) Companies that are public-listed but are in the secondary bourses such as the ACE market, Malaysia Online Trading Platform for Unlisted Market (MyULM) or in secondary markets / SME exchanges / unlisted markets in other countries will still be considered as SMEs for as long as they fulfil the qualifying criteria.

(ii) Subsidiaries of firms in (i) will also be considered as SMEs for as long as they fulfill the qualifying criteria.

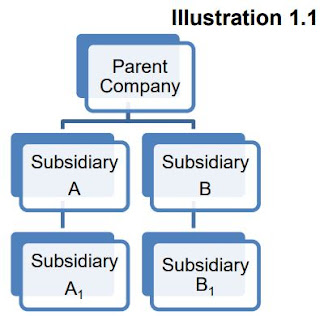

Subsidiaries refer to entities where the parent company has controlling power over the entities either via:

- The composition of its board of directors; or

- Has more than 50% of its voting power/ share capital (excluding preference shares); or

- Indirectly, through another entity which is a subsidiary that is owned by the parent company (two level subsidiary). For this, again the conditions in (i) and (ii) will apply (refer to Illustration 1.1).

These are also pre-conditions to be eligible for Government assistance programmes. It is also recommended that a minimum local equity of more than 50% be imposed depending on the objectives of the programmes, in order to qualify for Government assistance.

Exclusions

The following businesses will not be deemed as SMEs and also do not qualify for Government assistance:

Public-listed companies in the main board such as Bursa Malaysia or main bourses in other countries.

Subsidiaries of the following entities:

(i) Public-listed companies in the main board.

(ii) Large firms, multinational corporations (MNCs), Government-linked companies (GLCs), Syarikat Menteri Kewangan Diperbadankan (MKDs) and State-owned enterprises.

In this case, if the parent company in the Illustration 1.1 falls under (i) and (ii), then its subsidiaries (A and B) and their next level of subsidiaries (A1 and B1) are not eligible for assistance.

Frequently Asked Questions (FAQs)

Q: What if a business can fulfill only the sales turnover but not the employment

criteria?

A: A business will only need to satisfy one of the two criteria used in the definition in order

to be classified as SMEs. The use of ‘OR’ basis in the definition provides greater

flexibility for businesses to comply with the definition and thus be classified as SMEs.

Q: If a business can fulfill one criteria i.e sales turnover under the micro category and another criteria i.e employment under the small category, which category does the business belongs to?

A: In this case, the lower category will prevail i.e business will be deemed as a microenterprise.

Q: What if a particular SME owns a few subsidiaries to undertake different activities i.e sales & marketing, R&D, distribution etc. Does the definition take into account the total sales turnover or employees of the SME?

A: The calculation of the sales turnover and employees is based on a separate entity, not on a group basis. Therefore, as long as the businesses are registered under different entity, the subsidiaries are also SMEs if they meet the official criteria to be classified as SMEs.

Q: Can a listed company be classified as SMEs?

A: Listed companies in the main board will not be deemed as SMEs. However, firms listed in secondary bourses (such as ACE market, unlisted or SME exchange) will still be considered as SMEs if they fulfil the qualifying criteria.

Q: Can revenue generating organisations such as youth associations, trade unions, consumer associations etc. be defined as SMEs?

A: No, because these entities are not solely established for business purpose and they often have other purposes such as to provide social welfare for its members. The new definition has specified the scope of SMEs to only cover entities established for business purposes only.

Edited by: 浪子

Bibliography

SME Corp. Malaysia. (2013). Guideline for New SME Definition. Retrieved from

http://www.smecorp.gov.my/images/pdf/Guideline_New_SME_Definition_updated.pdf

New SME Definition in Malaysia

Reviewed by 浪子

on

August 27, 2018

Rating:

Reviewed by 浪子

on

August 27, 2018

Rating:

Reviewed by 浪子

on

August 27, 2018

Rating:

Reviewed by 浪子

on

August 27, 2018

Rating: